The Employees’ Provident Fund Organisation (EPFO) has announced a landmark decision to raise the minimum pension under the Employees’ Pension Scheme (EPS) from ₹1,000 to ₹7,000 per month starting in 2025. This sevenfold increase comes with the additional introduction of Dearness Allowance (DA) benefits for pensioners, addressing long-standing demands for improved financial security among retirees.

Key Changes in the EPFO Pension Scheme

The pension reform introduces two major changes that will significantly impact the lives of over 6 million pensioners across India:

- Minimum Pension Increase: The minimum pension amount will jump from the long-stagnant ₹1,000 to ₹7,000 per month, providing substantial relief to pensioners, especially those in lower-income brackets.

- Introduction of Dearness Allowance: For the first time, EPF pensioners will receive DA benefits linked to inflation, helping protect their purchasing power against rising costs of living. This allowance will be adjusted periodically based on inflation indices.

These reforms represent a significant advancement in India’s social security framework, aligning EPF pensions more closely with other government pension schemes.

Why This Increase Was Necessary

The pension hike addresses several critical issues that pensioners have faced for years:

- Stagnant Pension Amount: The minimum pension had remained fixed at ₹1,000 for many years despite significant increases in living costs.

- Rising Inflation: Many pensioners struggled to afford basic necessities, healthcare, and proper nutrition due to the eroding purchasing power of their pension.

- Disparity with Other Schemes: EPF pensions lagged considerably behind other government pension schemes, creating inequity in the retirement system.

- Financial Vulnerability: Millions of low-income retirees depend entirely on EPF pensions for survival, making this increase essential for their financial security.

Impact on Pensioners’ Lives

The revised pension structure is expected to transform the quality of life for millions of retirees:

- Enhanced Financial Security: The substantial increase provides greater stability, reducing dependency on family members or additional income sources.

- Better Access to Healthcare: With more financial resources, pensioners can afford better medical care and preventive health services.

- Improved Nutrition and Living Conditions: The increased pension enables retirees to maintain proper nutrition and more comfortable living arrangements.

- Dignity in Retirement: The reforms acknowledge the contributions of workers to the nation’s economy and ensure they can live with dignity after retirement.

Dearness Allowance: A Game-Changer

The introduction of DA benefits marks a significant shift in how EPF pensions will function moving forward:

- Inflation Protection: By linking benefits to inflation rates, the new system ensures that pension values maintain real purchasing power over time.

- Regular Adjustments: DA will be revised periodically, providing timely relief against price increases without requiring new policy decisions.

- Economic Stability: This mechanism creates a more stable and predictable financial future for pensioners regardless of economic fluctuations.

Broader Economic and Social Impact

Beyond individual benefits, the pension hike is expected to have wider implications:

- Reduced Elderly Poverty: The increased minimum pension directly addresses poverty among elderly citizens who rely solely on pension income.

- Economic Stimulus: Higher pension payments will increase spending capacity among millions of retirees, potentially boosting local economies.

- Reduced Family Burden: With better pension benefits, the financial responsibility on working family members to support elderly parents may decrease.

- Social Welfare Enhancement: The reforms strengthen India’s social security framework, bringing it closer to international standards.

Frequently Asked Questions

Q1: When will the new pension amount come into effect? A: The revised pension structure with the ₹7,000 minimum and DA benefits is scheduled to be implemented starting in 2025.

Q2: Will all EPF pensioners receive ₹7,000? A: ₹7,000 is the new minimum amount. Pensioners already receiving more than this amount will continue to receive their existing pension, now with added DA benefits.

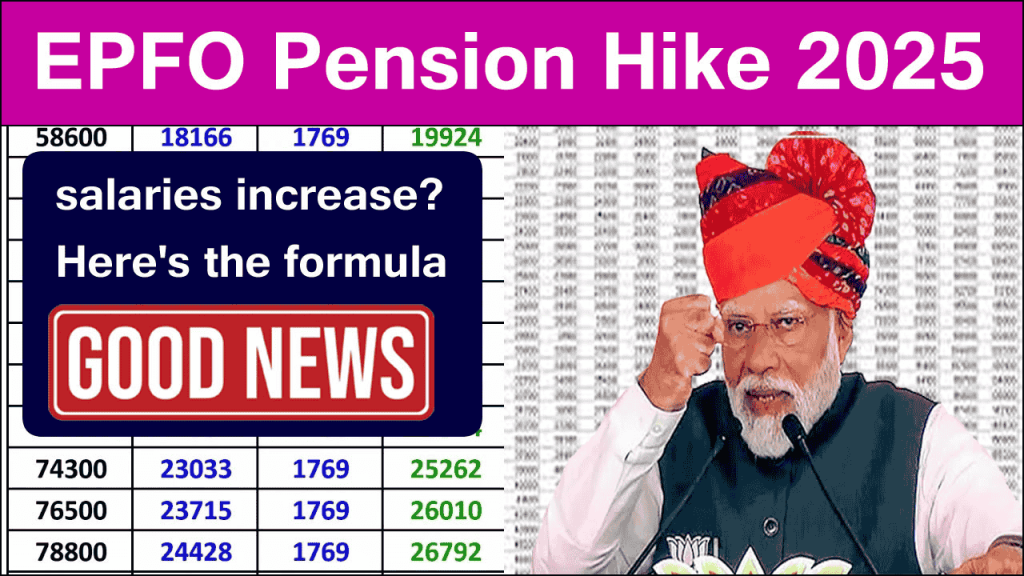

Q3: How will the Dearness Allowance be calculated? A: DA will be calculated based on inflation indices, similar to how it’s determined for government employees. The exact formula and periodic adjustment schedule will be announced closer to implementation.

Q4: Do pensioners need to apply for the increased pension? A: No. The increase will be automatically implemented for all eligible pensioners under the EPF scheme.

Q5: How many people will benefit from this pension hike? A: Over 6 million EPF pensioners across India will benefit from the increased pension amount and DA benefits.

Q6: Will family pensioners also receive the increased amount? A: Yes, the minimum pension revision will apply to all categories of pensioners under the EPF scheme, including family pensioners.

Q7: How does this compare to other pension schemes? A: This increase helps bridge the gap between EPF pensions and other government pension schemes, though some differences in structure and benefits remain.

Q8: Will there be any changes to the EPF contribution structure? A: The announcement focuses on pension benefits rather than contribution structures. Any changes to contribution requirements would be communicated separately.